Understanding inflation, deflation and stagflation: what you need to know

Understanding inflation, deflation and stagflation can be confusing - what is the difference between them? Why are they important? When it comes to the economy, knowing and understanding these concepts can be very helpful in making savvy financial decisions. This blog post will explain each term, why they're important and how they affect our daily lives. Read on to get a better understanding of inflation, deflation and stagflation!

What is inflation and how does it affect the economy

Inflation is an economic term used to describe a broad increase in the price of goods and services over time. For measuring inflation, all goods and services that households consume are taken into account, including:

- everyday items (such as food, newspapers and petrol)

- durable goods (such as clothing, PCs and washing machines)

- services (such as hairdressing, insurance and rented housing)

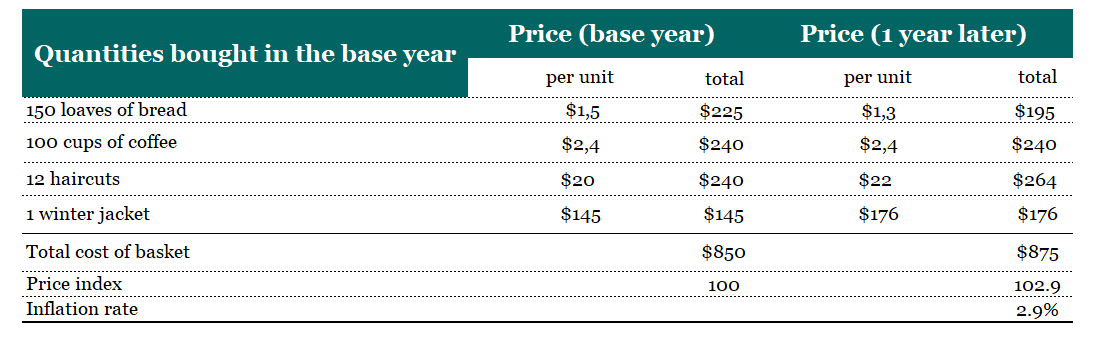

When calculating the average increase in prices, the prices of products we spend more on – such as electricity – are given a greater weight than the prices of products we spend less on – for example, sugar or postage stamps.

All the goods and services consumed by households during the year are represented by a “basket” of items. Every product in this basket has a price, which can change over time. The annual rate of inflation is the price of the total basket in a given month compared with its price in the same month one year previously.

When inflation rises, the purchasing power of money decreases – meaning that people need more money to buy the same item. This can make it hard for consumers to afford everyday items, as prices keep rising faster than wages. Inflation can also decrease the value of investments, as inflation erodes purchasing power.

Inflation is a major issue in many countries across the world, with some of the highest inflation rates seen in Venezuela, South Sudan and Zimbabwe. In these countries inflation has been rising rapidly over recent years as their economies struggle to keep up with demand for goods and services. This has led to prices increasing drastically, reducing people’s ability to purchase items they need or want. As inflation continues to rise it can have an even more serious effect on citizens who are already living in poverty, making it harder for them to make ends meet.

Differences between CPI and HICP

The rate used to express the level of inflation is called Consumer Price Index (CPI). Every country uses its own CPI, which is calculated in different ways and may not always be reliable.

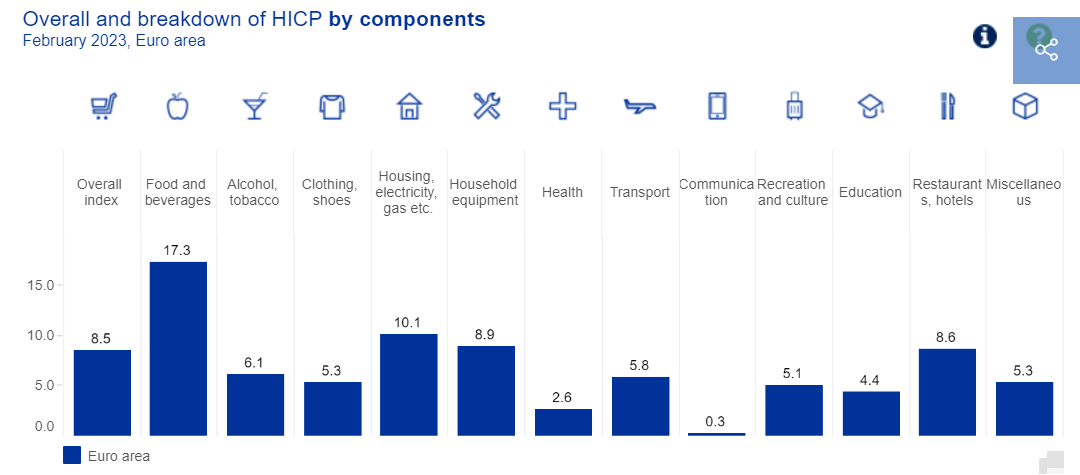

In Europe, inflation is measured using the Harmonized Index of Consumer Prices (HICP). It’s a common inflation indicator applied to all EU member states, Norway and Iceland. This inflation measure has been used since 1997 when it replaced the inflation rate of the different Member States. It is “harmonised” because all the countries in the European Union follow the same methodology. This ensures that the data for one country can be compared with the data for another. The HICP is compiled by Eurostat and the national statistical institutes in accordance with harmonised statistical methods. The inflation rate is also used in assessing whether a country is ready to join the euro area.

HICP covers, on average, around 700 goods and services and it reflects average household expenditure in the euro area for a basket of products. If you are interested you can read the full product range covered by the HICP and current inflation rates.

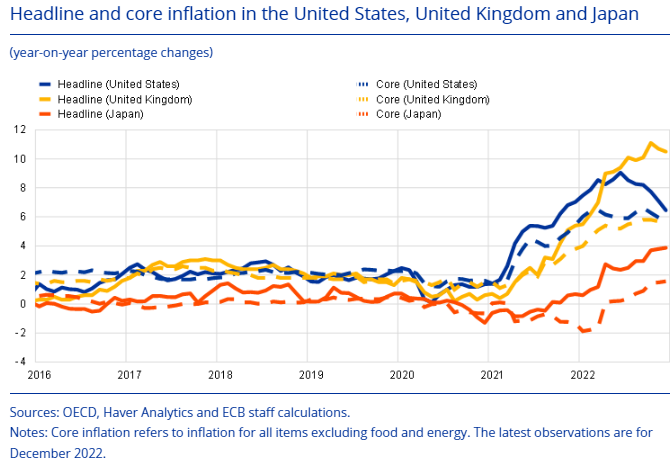

When comparing inflation levels across countries, it is important to be as consistent as possible otherwise it would be almost like comparing oranges with apples. For example the headline inflation figure includes inflation in a basket of goods that includes commodities like food and energy. It is different from core inflation, which excludes food and energy prices (due to their volatility).

What causes inflation?

The main causes of inflation can be grouped into three broad categories:

- Demand-pull: prices start to rise when the demand for goods and services outstrips what is available. This could be due to higher spending on behalf of consumers, businesses or governments, as well as an increase in net exports. As a result of this imbalance between supply and demand, companies can charge more while they look to hire new staff at higher wages than before - inflating prices all around! Firms may also increase the prices of their goods and services to cover their higher labor costs. More jobs and higher wages increase household incomes and lead to a rise in consumer spending, further increasing aggregate demand and the scope for firms to increase the prices of their goods and services. When this happens across a large number of businesses and sectors, this leads to an increase in inflation.

- Cost-push: it occurs when the total supply of goods and services in the economy which can be produced falls, that is often caused by an increase in the cost of production. If aggregate supply falls but aggregate demand remains unchanged, inflation is ‘pushed’ higher. An increase in the price of inputs (such as oil or raw materials) pushes up production costs. As firms are faced with higher costs they tend to produce less and raise the prices of their goods and services. This can have flow-on effects by pushing up the prices of other goods and services. For example, an increase in the price of oil will initially lead to higher petrol prices. However, higher petrol prices will also make it more expensive to transport goods from one location to another which, in turn, will result in increased prices for items like groceries.

- Inflation expectations: they are the beliefs that households and firms have about future price increases. For example, if firms expect future inflation to be higher and act on those beliefs, they may raise the prices of their goods and services at a faster rate. Similarly, if workers expect future inflation to be higher, they may demand higher wages to make up for the expected loss of their purchasing power. These behaviors can contribute to a higher rate of actual inflation so that expectations about inflation become self-fulfilling.

What caused the inflation to spike in 2021 and 2022?

From global shipping issues to the invasion of Ukraine, there was no shortage of supply-side factors that pushed inflation up in 2020. But it wasn't all on the supplier's side - an influx of cash into households and businesses during a pandemic drove demand through the roof as people couldn't spend money anywhere else! This created a unique situation where both supply shortages AND higher demands were driving prices further than expected.

No one knows for sure exactly how much these different factors contributed. But one study by economists at the New York Federal Reserve estimated that 40% of the rise in prices in 2021 was due to supply-side factors, and 60% to demand-side factors.

Optimal inflation

Inflation is an important economic indicator that affects the cost of goods and services for consumers, as well as investments and savings. It is important to maintain inflation at a level that does not put too much strain on individuals or businesses. Generally speaking, economists agree that an optimal inflation rate should be around 2%.

Why exactly 2%? Well, this allows prices to increase gradually over time without causing too much disruption in the economy, while also providing incentive for businesses to invest in new technology and resources which can help stimulate growth. Too high inflation can cause major disruptions such as hyperinflation or deflation which can lead to economic recessions.

On the other hand, having no inflation at all may result in stagnation with little incentive for businesses to innovate or expand operations.

Central banks in every country act, among other things, as guardians of inflation and can put in place monetary policies (read change interest rates) to ensure inflation stays in the optimal range.

Having a 2% inflation does provide a safety margin to make sure monetary policy remains effective when it needs to respond to inflation that is too low. Having a margin against deflation is important because there are limits to how far interest rates can be cut.

Therefore, maintaining inflation within this range helps ensure a healthy balance between price stability and economic growth.

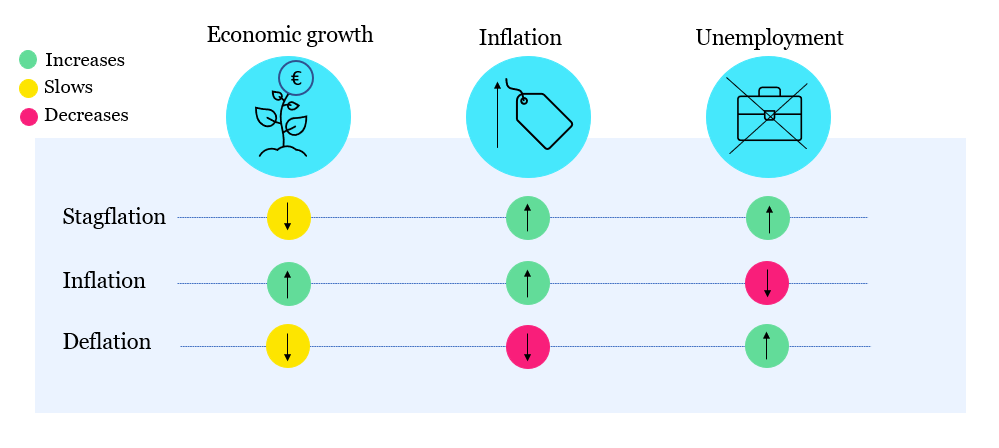

The difference between deflation and stagflation

If inflation can be dangerous, its opposite, i.e. the generalized decrease in prices, called deflation, can also damage the citizens and the economy of a country: consumers could decide to postpone their purchases while waiting for prices to drop; household consumption would decrease and, consequently, businesses could reduce investments and personnel, with a knock-on effect on consumption and the economy (deflationary spiral).

Unlike inflation, deflation can immediately lead to an increase in the purchasing power of one's income and savings; those who are in debt will instead be further disadvantaged by the drop in prices, precisely because the sums they have to repay will have a greater real value. In the long term, incomes would still be destined to decrease if not to disappear due to the loss of a job or a reduction in the volume of business!

One of the most famous episodes of deflation happened in Japan in the late 1990s, a phenomenon called “the lost decade”. This was caused by a combination of deflation, falling wages, and an aging population that resulted in a decrease in consumer spending. During this time, inflation dropped below zero for five consecutive years, leading to decreased demand for goods and services as well as reduced investment from businesses. The Japanese economy eventually recovered from this recession with help from government stimulus packages but it had long-term effects on the country's economic growth.

Stagflation (stag for stagnation, and flation for inflation) is a term used to describe when inflation occurs alongside high unemployment and low economic growth. This means that prices of goods and services are increasing, but the economy is not producing enough jobs or output to keep up with demand. Stagflation can have a devastating effect on an economy as it discourages consumer spending and encourages businesses to reduce their investments due to uncertain conditions. It can also lead to reduced wages as workers become less productive in a low-growth environment. In extreme cases, stagflation can result in hyperinflation which can cause mass disruptions within an economy.

Common misconceptions about inflation, deflation and stagflation

When it comes to inflation, deflation and stagflation, there are many misconceptions that can lead to misinformed decisions. Inflation is often seen as only a negative phenomenon, when in reality it can have both positive and negative effects on an economy. Deflation is also often viewed as beneficial for consumers, when in fact, the decreased demand resulting from lower prices can hurt businesses. Lastly, stagflation has been described as inflation plus unemployment but this isn’t always the case - inflation may remain low while economic growth stalls due to other factors besides high unemployment rates. It's important to understand these differences in order to make informed decisions regarding investments and savings plans during different stages of the business cycle.

How Governments can combat high inflation and deflation rates

One way governments can address high inflation rates is through fiscal policy tools like taxation or government spending - both of which work by decreasing aggregate demand within an economy, thus reducing inflationary pressures over time.

Monetary policy tools like increasing interest rates or adjusting the reserve requirement ratio are also effective ways to reduce inflation by making borrowing more expensive for consumers which decreases their purchasing power.

Additionally, governments may implement price controls such as setting maximum prices for certain goods and services in order to keep them from becoming too expensive during inflationary times. By controlling inflation through these tools, central banks can ensure that economic growth remains healthy and consumer spending power is maintained.

How to invest during a period of inflation

Bonds are normally impacted the most during inflationary periods. They start to lose their value as inflation increases, since the fixed interest rate does not keep up with inflation. Investing in inflation-protected bonds like TIPS or inflation indexed annuities can help mitigate risk and provide some protection against inflation. It is also important to diversify your investments across different asset classes so that you are not overly exposed to inflationary risks. Lastly, remember that inflation is usually cyclical in nature, so investing with a long-term outlook and holding onto high quality investments can help you weather any inflationary storms.