The surprising economics of a world with 2 billion seniors

The global population is undergoing a significant transformation, characterized by a remarkable increase in the number of seniors. By 2050, it is projected that the world will be home to 2.1 billion seniors, a staggering figure that demands attention and understanding of the economics involved.

In the past this demographic shift has been associated to the term "silver tsunami", referring to the baby boomer generation reaching retirement age. The implications of this demographic shift are far-reaching. As societies age, there is a need to adapt policies, healthcare systems, and labor markets to accommodate the needs and contributions of seniors. Understanding the surprising economics of a world with 2+ billion seniors is crucial to ensure sustainable economic growth, social stability, and the well-being of individuals across generations.

Life expectancy

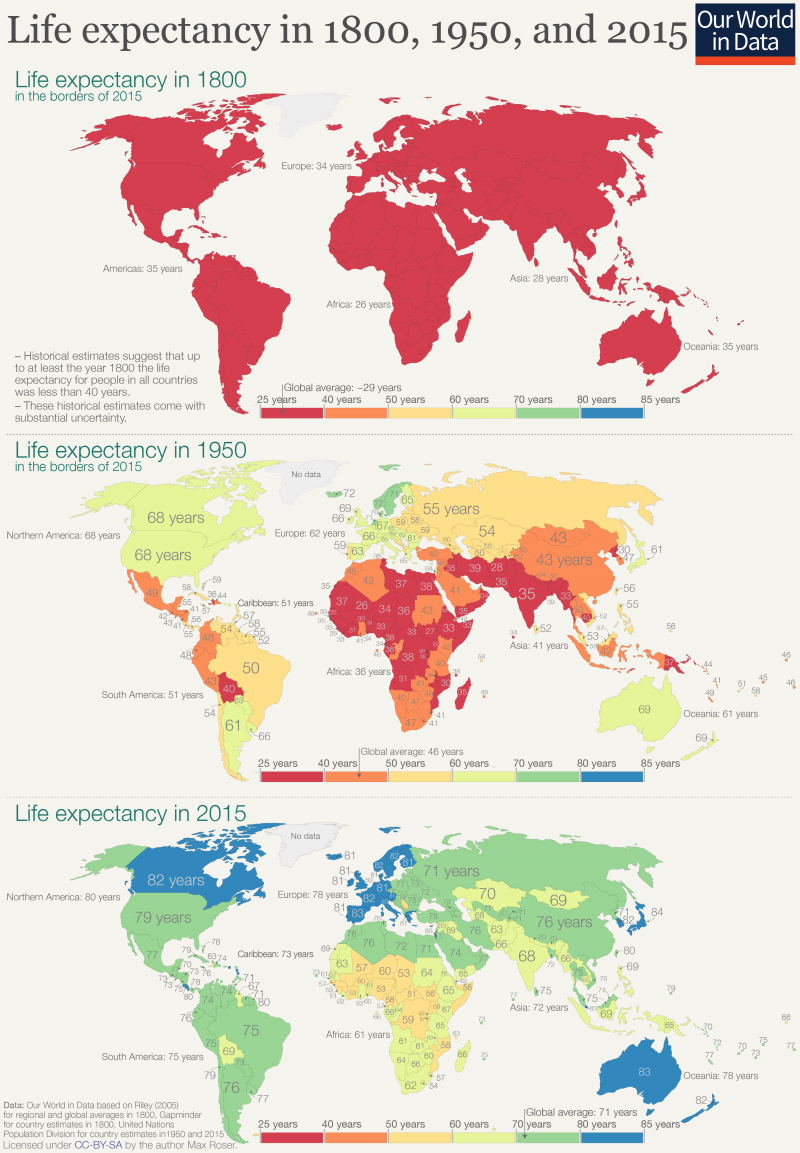

If we look at a fairly limited period of human history, let's say the past 200 years, we can see that life expectancy has undergone remarkable changes, reflecting significant advancements in healthcare, technology, and living conditions. At the beginning of the 19th century, life expectancy was relatively low, often hovering around 30 to 40 years in many countries. Factors such as limited medical knowledge, high infant mortality rates, infectious diseases, and inadequate sanitation played a significant role in these shorter lifespans. However, with the advent of public health initiatives, improved healthcare access, better sanitation practices, and advancements in medical treatments, life expectancy steadily increased. The development of antibiotics, vaccines, and widespread disease prevention measures further contributed to the decline in mortality rates. By the turn of the 21st century, life expectancy had more than doubled in many parts of the world, reaching averages of around 70 to 80 years or even higher in some countries. These advancements have not only resulted in longer lives but have also brought about societal and economic changes, as older individuals contribute to communities, economies, and the pursuit of knowledge and experience.

The aging population phenomenon

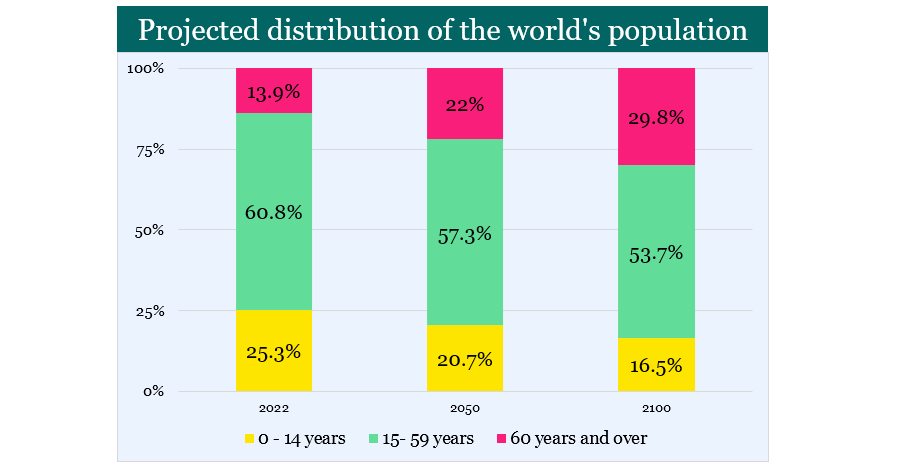

Living longer also means...more elderly people. By 2050, the global population aged 60 years or older is projected to reach 2.1 billion, comprising around 21% of the total population. According to the latest population estimates and projections from UN DESA’s Population Division, 1 in 6 people in the world will be over the age 65 by 2050, up from 1 in 11 in 2019. The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million. In regions such as Europe and North America, the proportion of seniors is expected to exceed 30%.

This demographic shift poses significant challenges for economies worldwide. The increased demand for healthcare and long-term care services places a strain on already stretched healthcare systems. According to the World Health Organization (WHO), healthcare spending for seniors is estimated to reach 10-20% of GDP in many countries by 2050. Additionally, the strain on pension systems and public finances due to an aging population requires proactive policy measures to ensure sustainability.

Challenges and opportunities

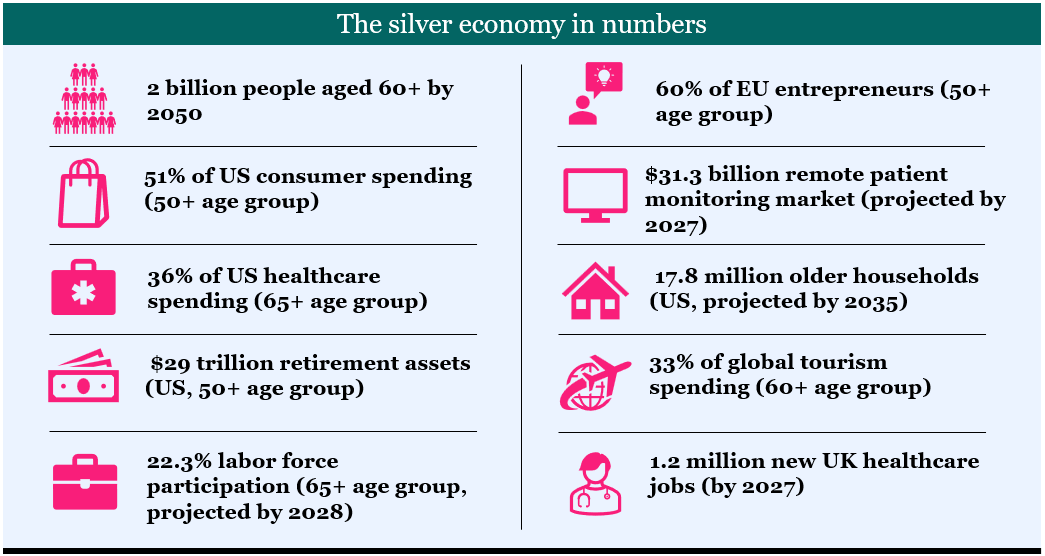

The economic challenges posed by an aging population are multi-faceted. The surge in demand for healthcare and long-term care services not only puts pressure on public budgets but also creates opportunities for the growth of healthcare-related industries. The silver economy, which encompasses goods and services tailored to the needs of seniors, is projected to be worth $15 trillion by 2020. Industries such as pharmaceuticals, medical devices, leisure, and technology stand to benefit from catering to the growing demands of this demographic.

Moreover, seniors themselves contribute to economic growth through consumer spending. According to a study by the Organization for Economic Co-operation and Development (OECD), seniors' consumer spending accounts for a significant share of total consumption expenditure. Their spending power and diverse needs create market opportunities and drive economic activity in various sectors.

Another important aspect is the intergenerational exchange of knowledge and experience. As the number of seniors grows, societies have the opportunity to tap into this vast pool of wisdom and expertise. This can lead to innovations, mentorship programs, and collaborations that can benefit the economy as a whole.

The shift in labor force dynamics

The aging population has profound implications for labor markets. As more individuals reach retirement age, there is a potential for labor shortages and skill gaps. The United Nations estimates that by 2050, the global labor force will experience a decline of around 205 million people due to aging. This decrease in the working-age population can hamper productivity and economic growth if not effectively managed.

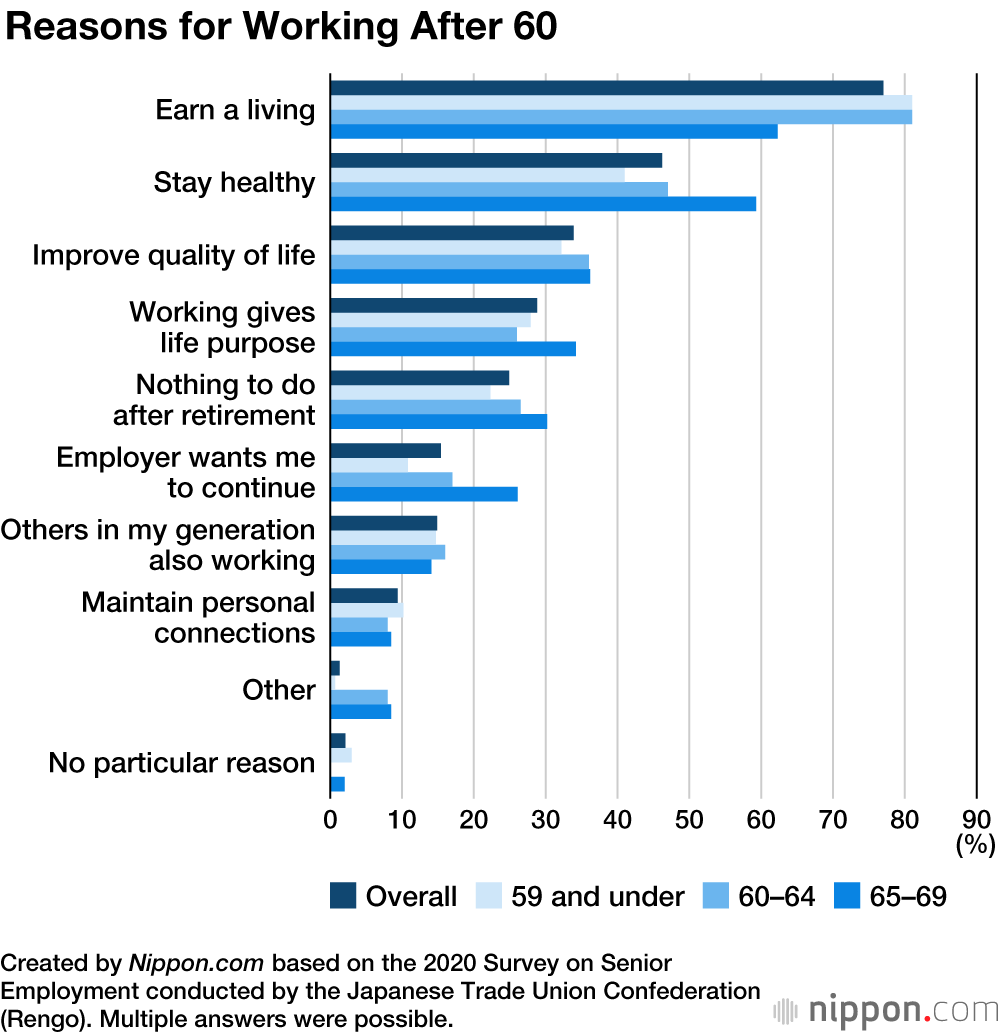

To mitigate labor shortages, policies need to encourage workforce participation among seniors. In many countries, there is a growing recognition of the value and capabilities of older workers. Governments and businesses are implementing measures such as flexible work arrangements, retraining programs, and initiatives to combat age discrimination. By harnessing the skills and experience of seniors, economies can benefit from their contributions to productivity and knowledge transfer. Japan is a country where it's considered normal to work even beyond the traditional retirement age:

Moreover, the emergence of the gig economy and remote work options provide opportunities for seniors to continue participating in the labor market on their terms. This flexibility can enable seniors to remain economically active while maintaining a fulfilling work-life balance.

The changing face of healthcare

An aging population necessitates a shift in the healthcare landscape. With a larger proportion of seniors, there is an increased demand for healthcare services and specialized care. This puts significant strain on healthcare systems worldwide.

Technological advancements play a crucial role in addressing the healthcare needs of seniors. The integration of telemedicine, remote monitoring devices, and artificial intelligence in healthcare delivery can improve access, efficiency, and quality of care for seniors. These innovations have the potential to reduce healthcare costs and alleviate the burden on healthcare systems.

Investing in senior healthcare also has substantial economic implications. The return on investment in preventative care, chronic disease management, and innovative healthcare solutions can lead to cost savings in the long run. By prioritizing senior healthcare, economies can promote healthy aging, improve the quality of life for seniors, and reduce the economic burden associated with age-related illnesses.

Financial considerations and retirement savings

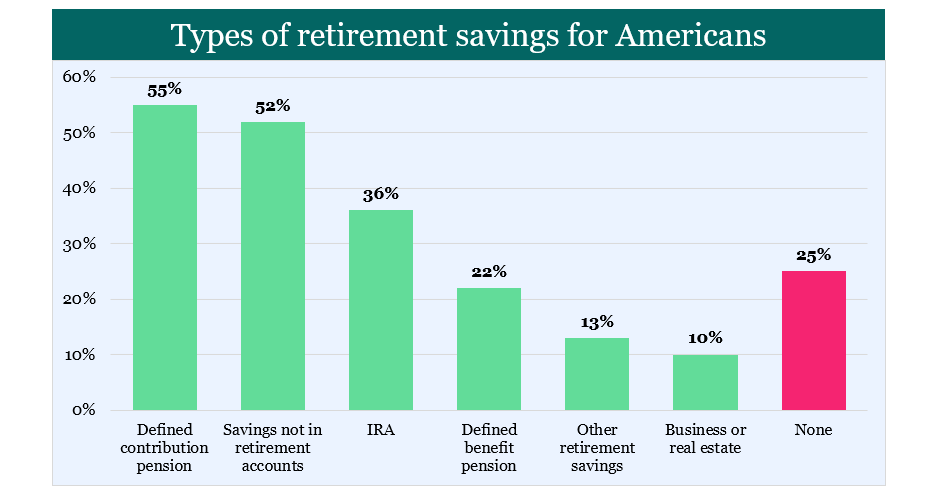

One of the key challenges faced by seniors is ensuring sufficient retirement savings. An aging population places strain on pension systems, as fewer workers support a larger number of retirees. According to the World Economic Forum, there is a global retirement savings gap of $400 trillion, which highlights the magnitude of the challenge.

Addressing this gap requires reforms in pension systems and retirement income strategies. Governments and individuals need to explore alternative retirement savings options, such as voluntary savings plans and diversified investment portfolios. Encouraging financial literacy and promoting early retirement planning can help individuals make informed decisions about their financial future.

Additionally, the impact of an aging population on investment markets should be considered. The changing demographics influence investment preferences, risk profiles, and asset allocation strategies. Investors and financial institutions must adapt to the evolving needs and preferences of seniors to ensure stable and sustainable investment environments.

Government policies and social security systems

Government policies play a vital role in addressing the economic impact of an aging population. Sustaining social security systems requires a multi-faceted approach that includes adequate funding, gradual retirement age adjustments, and incentivizing active aging.

Successful models from countries facing an aging population challenge can provide valuable insights. For example, Japan has implemented policies to encourage senior workforce participation and promote technology adoption in healthcare. Germany has implemented pension reforms to address the strain on its pension system. By studying these models and adapting best practices, governments can develop comprehensive strategies to address the economic challenges associated with an aging population.

Furthermore, intergenerational equity is crucial in maintaining social cohesion and ensuring support systems for seniors. Governments and societies need to strike a balance between the needs of different generations, promoting solidarity and inclusivity across age groups.

Investment opportunities

All these new dynamics create plenty of investment opportunities, that is if you decide to buy their shares (or an ETF containing their shares). Although there are some players that operate worldwide, the ocean is still big enough to have many companies, depending on the country or region. I suggest to do your own research (a.k.a. Google it), to understand who are the main players in the geography you want to invest into.

When it comes to the main areas of investment we have:

- Healthcare and pharmaceuticals: Investing in healthcare-related industries offers immense potential. The aging population requires increased access to healthcare services, medications, and medical devices. Investing in healthcare providers, pharmaceutical companies, biotechnology firms, and healthcare technology startups can be lucrative. Opportunities also exist in specialized areas like geriatric care, telemedicine, remote monitoring, and home healthcare services.

- Long-Term care facilities and services: As the elderly population expands, the demand for long-term care facilities, assisted living communities, and nursing homes rises. Investing in the development and management of such facilities can be profitable. Additionally, there is a growing need for home healthcare services, including personal care assistance, meal delivery, and home modification services. Investing in companies providing these services can cater to the needs of older individuals.

- Senior-friendly housing and real estate: Adapting housing options to meet the needs of older adults presents a significant investment opportunity. This includes designing and developing senior-friendly housing, retirement communities, and age-in-place modifications for existing homes. Investing in real estate properties located in areas with a high concentration of older adults can also be beneficial.

- Wellness and fitness: The aging population places a strong emphasis on maintaining health and wellness. Investing in businesses that cater to this market, such as fitness centers, wellness programs, nutrition services, and specialized exercise equipment, can yield substantial returns. Additionally, technology-driven solutions for remote monitoring, wearable devices, and healthcare apps targeting older adults are areas of potential growth.

- Financial services and retirement planning: As retirement becomes a priority for older individuals, there is a need for financial services tailored to their unique needs. Investing in companies that provide retirement planning, investment advisory services, and pension management solutions can cater to this growing market. Additionally, products like annuities, long-term care insurance, and reverse mortgages can be attractive investment opportunities.

- Leisure and travel: The leisure and travel industry can benefit from the increased disposable income and free time of the aging population. Investing in companies that offer travel services, vacation packages, specialized tours, and senior-friendly recreational activities can tap into this market. Retirement communities and active living communities with amenities like golf courses, spas, and social clubs are also areas of potential investment.

- Technology and innovation: technology-driven solutions tailored to older adults are in high demand. Investing in the development of smart home automation, assistive devices, wearable health monitoring devices, and communication platforms can address the unique needs of the aging population. Moreover, artificial intelligence (AI) applications for personalized healthcare, virtual reality (VR) for cognitive training, and robotics for assisted living support offer exciting investment opportunities.

Conclusion

The surprising economics of a world with 2+billion seniors demand our attention and proactive measures. The aging population phenomenon presents challenges such as increased demand for healthcare, strain on pension systems, and changes in labor dynamics. However, it also offers opportunities for economic growth, innovation, and profitable investments.

By understanding and addressing the economic implications of an aging population, governments, industries, and individuals can work together to build sustainable economies that support the well-being and prosperity of all generations.