The rise of SPACs: investing in special purpose acquisition companies for high returns

Special Purpose Acquisition Companies (SPACs) are becoming increasingly popular as a means of going public for companies. SPACs, also known as "blank-check companies," are formed with the purpose of raising capital through an initial public offering (IPO) and then using that money to acquire or merge with a private company. SPACs have become a preferred choice for investors seeking high returns in a short amount of time. In US in 2019, 59 were created, with $13 billion invested; in 2020, 247 were created, with $80 billion invested; and in the first quarter alone of 2021, 295 were created, with $96 billion invested. In 2020, SPACs accounted for more than 50% of new publicly listed U.S. companies.

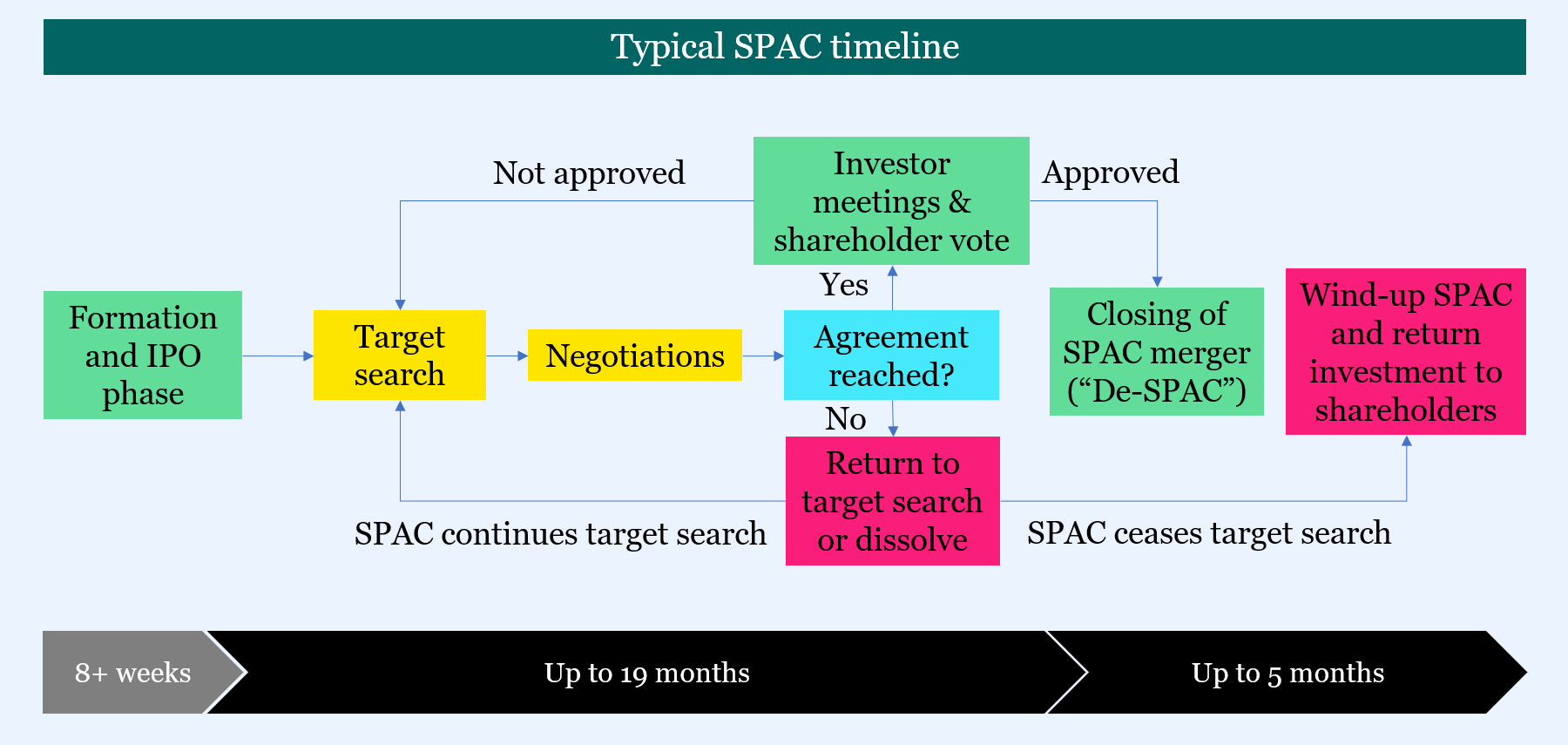

The SPAC life cycle

A SPAC is a publicly traded corporation with a two-year life span formed with the sole purpose of effecting a merger, or “combination,” with a privately held business to enable it to go public.

The SPAC IPO

A SPAC is created with the sole purpose of raising capital through an IPO. The capital raised is placed into a trust account, managed by the SPAC's management team, and invested in low-risk securities such as US Treasury bonds. The SPAC then begins to look for a private company to merge with or acquire, usually within a specified time frame of two years. The vast majority of investments in SPACs to date have come from institutional investors, often highly specialized hedge funds.

Original investors in a SPAC buy shares prior to the identification of the target company, and they have to trust sponsors who are not obligated to limit their targets to the size, valuation, industry, or geographic criteria that they outlined in their IPO materials.

Investors receive two classes of securities: common stock (typically at $10 per share) and warrants that allow them to buy shares in the future at a specified price (typically $11.50 per share).

The SPAC merger / reverse IPO

Once the SPAC has identified a target company, the SPAC's management team negotiates the acquisition terms with the target company. Most SPAC targets are start-up firms that have been through the venture capital process.

For target companies, SPACs normally offer specific advantages over other forms of funding and liquidity. For example compared with traditional IPOs, SPACs often provide higher valuations, less dilution, greater speed to capital, more certainty and transparency, lower fees, and fewer regulatory demands.

The target company is then evaluated and approved by the SPAC's shareholders, who vote on whether to proceed with the acquisition. If the shareholders approve the acquisition, the SPAC merges with the target company, and the target company becomes publicly traded.

If they decide to withdraw, they will receive their investment back with interest. Even if they decide to pull out, they can keep their warrants. In this sense, the SPAC provides them with a risk-free opportunity to evaluate an investment in a private company.

The role of the sponsor

A SPAC is typically created by a sponsor, an individual or group of individuals who have a background in finance, investment banking, or private equity. The sponsor is responsible for finding investors and raising the initial capital for the SPAC's IPO. The sponsor also receives shares in the SPAC for a nominal fee, usually 20% of the total shares. The sponsor's shares are known as "promote" and represent the sponsor's equity stake in the SPAC. If sponsors fail to create a combination within two years, the SPAC must be dissolved and all funds returned to the original investors. The sponsors lose not only their risk capital but also the not-insignificant investment of their own time.

Pros and Cons of investing in SPACs

It doesn't matter if you are the investor or the target of the investment, SPACs can be either a great opportunity or a risky proposition.

Pros

- The potential for high returns: SPACs can provide a substantial return on investment if the acquisition is successful. The investor's return is based on the appreciation of the target company's stock price after the merger.

- Opportunities to invest in private companies: SPACs provide investors the opportunity to invest in companies that may not have been available to the public otherwise.

- Limited downside risk: if the merger is unsuccessful or does not proceed, the funds in the trust account are returned to the shareholders.

- Simpler IPO process: that saves time and energy for all parties and gives sponsors more flexibility to set their targets’ narratives.

Cons

- Investing in the unknown: Since SPACs are formed without an identified target company, investors are essentially investing in an idea rather than a tangible asset.

- Time-limited: SPACs have a limited time frame of two years to acquire or merge with a target company. If a target is not identified within the specified time frame, the SPAC will liquidate, and the funds in the trust account will be returned to shareholders.

- Lack of transparency: The target company's financial information may not be publicly available, and investors may have limited information on the target company's operations, revenue, and profitability.

Key Considerations When Investing in SPACs

If you're now hooked up at the idea of investing in SPACs, there are few key considerations you should keep in mind.

Evaluating the sponsor and management team

Investors should consider the experience and track record of the sponsor and management team. Experienced sponsors with a history of successful investments can provide confidence to investors that the SPAC will be successful.

Analyzing the target company

Investors should conduct thorough due diligence on the target company, including analyzing the company's financials, operations, and management team. Investors should also evaluate the target company's growth potential and the competitive landscape of the industry.

Due diligence on the financials

Investors should conduct a detailed analysis of the target company's financial statements. This process involves reviewing the company's income statement, balance sheet, and cash flow statement. Investors should evaluate the company's revenue growth, profitability, and cash flow generation. Investors should also review the company's historical financial statements to identify any trends or patterns that may indicate future performance.

Investors should also evaluate the target company's accounting practices and the quality of the financial statements. Investors should assess the company's revenue recognition policies, accounting for expenses, and any potential accounting issues.

A recipe for long-term SPAC success

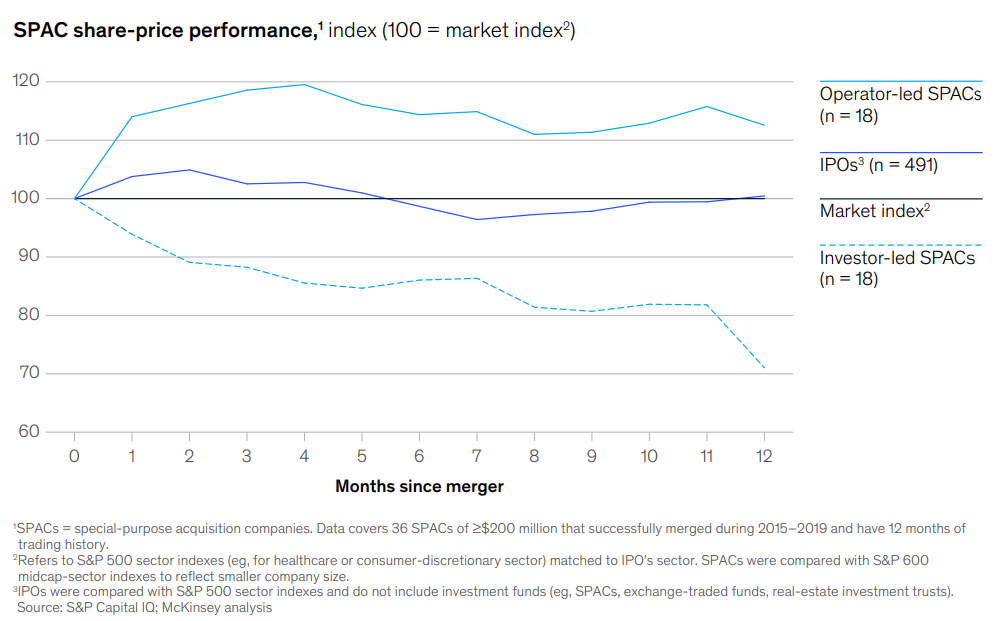

In a report of 2020, McKinsey analyzed the performance of recent SPACs to boil down the key differentiators that made them stand out from the competition. SPACs that are led or co-led by operators, as in whose chair or CEO has former C-suite operating experience and not purely financial or investing experience, tend to outperform throughout the deal cycle. One year after merging, operator-led SPACs outperformed both other SPACs (by about 40 percent) and their sectors (by about 10 percent). This is because operator-led SPACs behave differently from other SPACs in two ways: they specialize more effectively, and they take greater responsibility for the combination’s success.

Operator-led SPACs have a higher tendency to identify an industry focus in their initial SEC filings (generally on their areas of expertise). Such initial filings typically signal to investors that the SPAC’s leaders will focus their resources on the areas they know best. Resources are scarce, so the focus matters; SPACs only have 18 to 24 months to find a deal, with minimal working capital. A narrower, more informed search may yield more effective sourcing, higher quality diligence, better value-creation plans, and ultimately, better-performing assets.

Case Studies

After all the theory, let's take a quick look over a couple real-world examples of successful SPAC investments :

- DraftKings: a digital sports entertainment and gaming company, went public through a SPAC merger in 2020. The SPAC was sponsored by Diamond Eagle Acquisition Corp. and merged with DraftKings in a deal valued at $3.3 billion. The merger was successful, and DraftKings' stock price has since increased by over 250%.

- Virgin Galactic: a spaceflight company, went public through a SPAC merger in 2019. The SPAC was sponsored by Social Capital Hedosophia and merged with Virgin Galactic in a deal valued at $1.5 billion. The merger was successful, and Virgin Galactic's stock price has since increased by over 300%.

- Lucid motors: the electric vehicle manufacturer went public in 2021 with a deal worth a staggering $24 billion.

- Matterport: they have become the standard for 3D space capture to create interactive 3D models of spaces. When they went public through a SPAC the deal was approximately $2.3 billion.

What is the difference between SPAC and IPO?

SPAC and IPO are two different methods used by companies to go public and raise capital.

A SPAC (Special Purpose Acquisition Company) is a publicly traded company formed with the sole purpose of acquiring or merging with another company. A SPAC raises capital through an initial public offering (IPO) and uses the funds to identify and acquire a target company within a specified timeframe. Once the acquisition is completed, the target company essentially becomes a publicly traded company without going through the traditional IPO process.

On the other hand, an IPO (Initial Public Offering) is the process through which a private company offers its shares to the public for the first time. In an IPO, the company hires investment banks to underwrite the offering and help determine the initial price of the shares. The company goes through a rigorous regulatory process, including filing a prospectus with the securities regulators, and once approved, the shares are listed on a stock exchange for public trading.

In summary, a SPAC is a company created to acquire another company, while an IPO is the process through which a private company becomes publicly traded. SPACs offer an alternative route to going public, bypassing some of the regulatory hurdles and timelines associated with traditional IPOs.

How to Invest in SPACs

Investors can invest in SPACs through their brokerage account, just like they would invest in any other stock. Investors should research the available SPACs and evaluate the sponsor and management team, as well as the target company. Investors should also consider the risks associated with investing in SPACs, including the potential for the SPAC to fail to identify a suitable target company or the target company to underperform after the merger.

Conclusion

SPACs have gained popularity as a means of going public for companies and as a potential investment opportunity for investors seeking high returns. However, investors should conduct thorough due diligence on the sponsor, management team, and target company before investing in a SPAC. Investing in SPACs can be risky, but with careful consideration and analysis, investors may find attractive investment opportunities in this emerging market.

In summary, SPACs can be an attractive investment opportunity for investors seeking high returns, but they come with risks. Investors should evaluate the sponsor and management team, conduct thorough due diligence on the target company, and assess the financial statements before investing in a SPAC. With careful consideration and analysis, investors may find attractive investment opportunities in this emerging market.