Wings of wealth: reader interviews on financial freedom #2

Wings of Wealth is a series of interviews with the Wealthy Parrot readers, focusing on their experiences and insights regarding financial freedom. If you want to tell your story, feel free to write me to info@wealthyparrot.com.

Hi Peter and welcome to Wealthy Parrot! Can you start by briefly introducing yourself and share a bit about your background and your current profession?

Just after graduating from high school, I seized the opportunity to join a local bank that was on the lookout for young talents. A few years later, while working full-time, I earned a Bachelor degree in Economics through an online university. I further honed my expertise by completing an Executive course in Risk Management at the London School of Economics (LSE). In my career in the banking sector, I've assumed roles of increasing responsibility. I currently hold a position in corporate finance at a reputable national bank.

At what age did you start your journey towards financial independence and what motivated you to do so?

Somewhat by chance, before I was fully cognizant of the implications, I purchased my first apartment at the age of 22. It was a two-room apartment of new production, located in a province in northern Italy. I seized the opportunity presented by a mortgage offer that covered up to 90% of the purchase price. I eventually sold that apartment a few years later, generating a small profit.

Can you describe the initial financial strategies and plans you implemented to achieve financial independence?

I have consistently saved at least 50% of my income. During the initial years, this portion was entirely dedicated to repaying the principal on my first home mortgage. By the age of 30, thanks to an increase in my income, I managed to purchase a new primary residence in Milan. Instead of looking for something in the city center, that came with a price I could not afford, I did some research and ended up buying in an area under development. At the time there was not much there, but I thought it would go up in value over time as the city of Milan was growing bigger. It turns out my intuition was right. Today the value went up 50% but I expect to increase further in the next couple years.

Have you established multiple sources of income? If so, could you explain what they are and how you developed them?

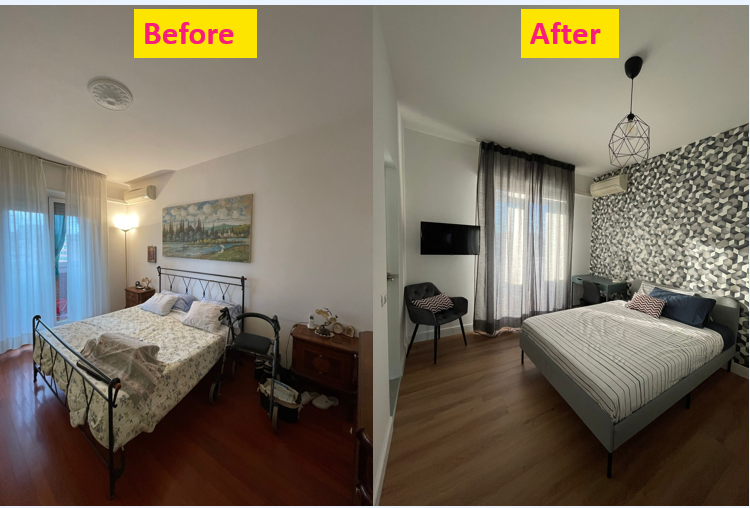

For many years, my sole source of income was my salary. Over time, my income increased, allowing me to allocate 50% of it not only towards paying off my mortgage principal, but also towards well-remunerated savings accounts. Between the ages of 33 and 39, I managed to set aside enough capital that enabled me to venture into a second real estate project in Milan. After buying it, I decided to renovate it completely to transform it into a 3 bedroom apartment, that I am now renting per room to young professionals. This venture not only covers the mortgage debt for the second home, but also generates a cash flow that I consider as an additional income.

How would you describe your investment philosophy and how has it evolved over the years?

Brick by brick. Initially, my focus was on preserving the value of my income rather than spending it on rent. The desire to own a home had two positive effects: paying off debt capital (thus increasing my asset value) and appreciating the value of my property (historically, Milan has always shown value appreciation in real estate). Over the years, I realized that besides preserving my income value, I could replicate a model that allowed for generation of additional income (by purchasing a second property and renting it out).

Given that you work in the banking industry, isn't it strange that you don't invest in stocks or ETFs?

I admit that my portfolio is not really diversified. From the very beginning my focus has always been on real estate for at least two reasons: first I've been exposed to the sector for work (hence I have a fairly good grip on the topic), and second I was using most of my savings to either repay a mortgage or accumulate for the other one, leaving no space for buying stocks. I do recognize though that I should start investing in at least some ETFs, which I plan to do in a few years, once I have repaid part of the mortgages I have.

How do you manage risks, especially considering the volatility of various investment markets?

I locked in all my mortgages at fixed rates during a favorable market period, a conscious choice although more costly compared to variable rates at that time. Paying a bit more to maintain long-term plan sustainability is a value that always pays off. Additionally, I always account for fixed costs in insurance, paying many premiums per year, all sustainable. In case of an accident, I don’t have to worry about eroding my capital. Acquiring debt (on projects or investments with higher returns than the debt rate) is more beneficial than depositing money in investment that yield well but still below the inflation rate.

How did you balance savings and expenses throughout your journey and which saving methods did you find most effective?

50% on expenses and 50% on savings. Regarding the savings portion, 70% went towards mortgage repayment and 30% towards sufficiently remunerated and low-risk saving accounts.

Have you had to manage significant debts? How did you tackle debt reduction and management?

In case of my last real estate venture, besides the mortgage, I had to take out several personal loans. Despite the debt value being quite high compared to the utilized equity, the business plan developed for this specific real estate operation confirmed the debt's sustainability as it's repaid through rental income.

What were some of the biggest challenges or setbacks you faced and how did you overcome them?

Before purchasing my second home, a bank denied my application, deeming my monthly repayment commitment too high compared to my income. I resubmitted my mortgage application to a different bank, presenting my business plan which showcased the rental income. The bank considered the rental income as part of my income, found my monthly expenditure sustainable, and approved the mortgage.

How important was your support system on your journey and who was instrumental for your financial growth?

In my case, it was very significant since being an employee in the banking sector, I was facilitated in obtaining my first mortgage at just 22 (that is not the norm in Italy). I built a credit track record with timely payments which supported all my subsequent credit requests.

How did you educate yourself on personal finance and investments, and do you have any resources to recommend?

My job, which involves dealing with corporate realities (including business plan construction, company management evaluations), allowed me to apply the same model to my personal investments, treating them as activities driven by a small business.

Did you have to make significant lifestyle changes to achieve your financial goals and, if so, what were they?

In the early stages of investing, I cut back on some extra expenses but luckily, with good planning, one can avoid having to change one’s lifestyle too much.

How are you approaching retirement planning and what advice do you have for others regarding this?

The real estate venture will provide a decent extra income once the debts are settled. I plan on replicating another real estate venture in the next 6-7 years to further support my financial independence. Additionally, I have always contributed monthly to a retirement plan, although this aspect only complements the pension; my primary goal is to exit the workforce early thanks to financial independence.

How have economic conditions and market trends influenced your journey and decision-making process?

The first people who influenced me were my parents who always had a savings and capital value protection mindset. Over the years, my academic and professional training, as well as the people I met both at work and in private life, have stimulated and driven me towards a more entrepreneurial mindset while always keeping risk under control as much as possible.

How did you maintain a work-life balance while pursuing financial independence, and how crucial was this for your wellbeing?

By avoiding total alienation to work or investments. I have always dedicated a good portion of my time and money to leisure and pursuing my passions, with traveling being a prime activity.

What advice would you give to someone in their 20s or 30s who is just starting on their path towards financial independence?

If possible, allocate a portion of your income to savings and invest it in assets that will appreciate over time. Try to incrementally increase your savings portion over time without sacrificing too much of your daily life and personal development.

Looking back, is there anything you would have done differently on your path towards financial independence, and what lessons have you learned along the way?

I would have ventured into debt that could generate value earlier. I learned that even without money, one can build and gain trust to obtain debt capital. If I had been aware of these tools earlier, with a project that could margin more value than the interest to be repaid for the contracted debt, I would have gone into debt and invested earlier.