Accounting 101: cash flow statement

It provides a summary of how cash flows have been created or dissolved during the fiscal period. The stress is on cash cause profit (in the income statement) is based on promises, not money coming in. So if you want to know whether a company has cash to pay employees, pay its bills, and even invest in equipment, you need to study cash flow. In a medium or big sized companies, there is normally a treasurer that overlooks at the health of the cash flow statement and how to optimize it such as hedge on FX rates, financing of investments, etc.

Regardless if the money is going into (cash inflow) or out (cash outflow) the company's bank account, we can group the flows into three main categories:

- Cash From or Used in Operating Activities: this category includes all the cash flow, that is related to the actual operations of the business: meaning to keep the doors open and the business operating. Some examples are: salaries, cash paid to vendors and cash received from customers. It is the most important (cash flow) category, as it indicates the health of the company. If the operating cash flow is healthy, it normally means the company is profitable and doing a good job in turning that profit into cash. That cash can also be used to finance the company growth without borrowing money.

- Cash From or Used in Investing Activities: this category refers to the cash flows to buy or sell assets either physical (a truck, a machine, a computer, etc.) or financial (stocks, bonds, etc.). We normally look for the size of this category compared to the revenue of the company, as it's a good indicator if the company is investing on its future growth. The definition of "enough" investments vary a lot based on the maturity (and size) of the company and the industry where it operates. For example service companies, typically invests less in assets than a manufacturing company.

- Cash From or Used in Financing Activities: financing refers to two things: borrowing and paying back loans on the one hand, and transactions between a company and its shareholders on the other. Examples of these operations are: when the company pays off a loan, buys back its own stock, or pays a dividend to its shareholders. This category tells you a mainly to what extent the company is dependent on outside financing (debt in general is not always bad, but it depends on the entity).

Now let's have a look at what items you can expect to find in the cash flow statement.

Cashflow statement: cash inflows

In this group there are all the new cash inflows of the fiscal period. Typical items include:

- Sale of good or services that got cashed in (the sale alone doesn’t generate a cash inflow! E.g. the customer, according to the contract, could buy this year but pay in 1 year).

- (New) cash from the shareholders: this is normally used to either grow the company e.g. to build a new manufacturing facility, expand into a new product line/segment, or to pay down outstanding long-term debt.

- A new bank loan: similar to the previous point, it's normally used for expansion or growth activities, repay a loan (e.g. when current interest rates are better than the old ones).

Cashflow statement: cash outflows

In this group there are all the new cash outflows of the fiscal period. As you can imagine it partially mirrors the cash inflow section:

- Payment of (purchased) goods or services: anything need to run the business, such as: salaries, payments made to suppliers of goods and services used in production, rent, interest payments and income tax payments.

- Dividends payout

- Reimbursement of bank loans

Free cash flow

Free cash flow is the money a company has left over after it has paid for everything it needs to continue operating, including capital expenditures (buildings, equipment, etc.), salaries, taxes and inventory. Free cash flow can be then distributed to creditors and securities holders, or can be used to pay off debt, expand operations, etc. There are different ways to calculate it, but the simplest formula is:

Free cash flow = Operating Cash flow - Capital Expenditures

Putting it all together

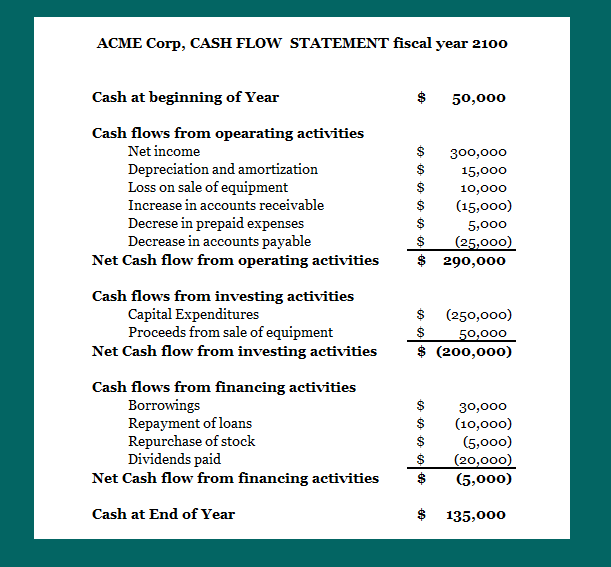

A very simple cash flow statement would look like the below:

Real life Example

The example above is very simple, but what about a cash flow statement of a real, and even better, famous company? Let's take a look at THIS article.