18 Saving strategies for 2024

Hello, savvy savers! Whether you're a recent college graduate, a seasoned professional, or gearing up for retirement, it's never too late or too early to smarten up your saving strategies. Before we dive into the techniques I thought it might be interesting to cover a couple points on saving in general.

What is saving?

I am sure you know what saving means, right? In essence is to set aside money. The thing is that the numbers, or savings rate, can vary a lot depending on what you look at. The most common definitions are:

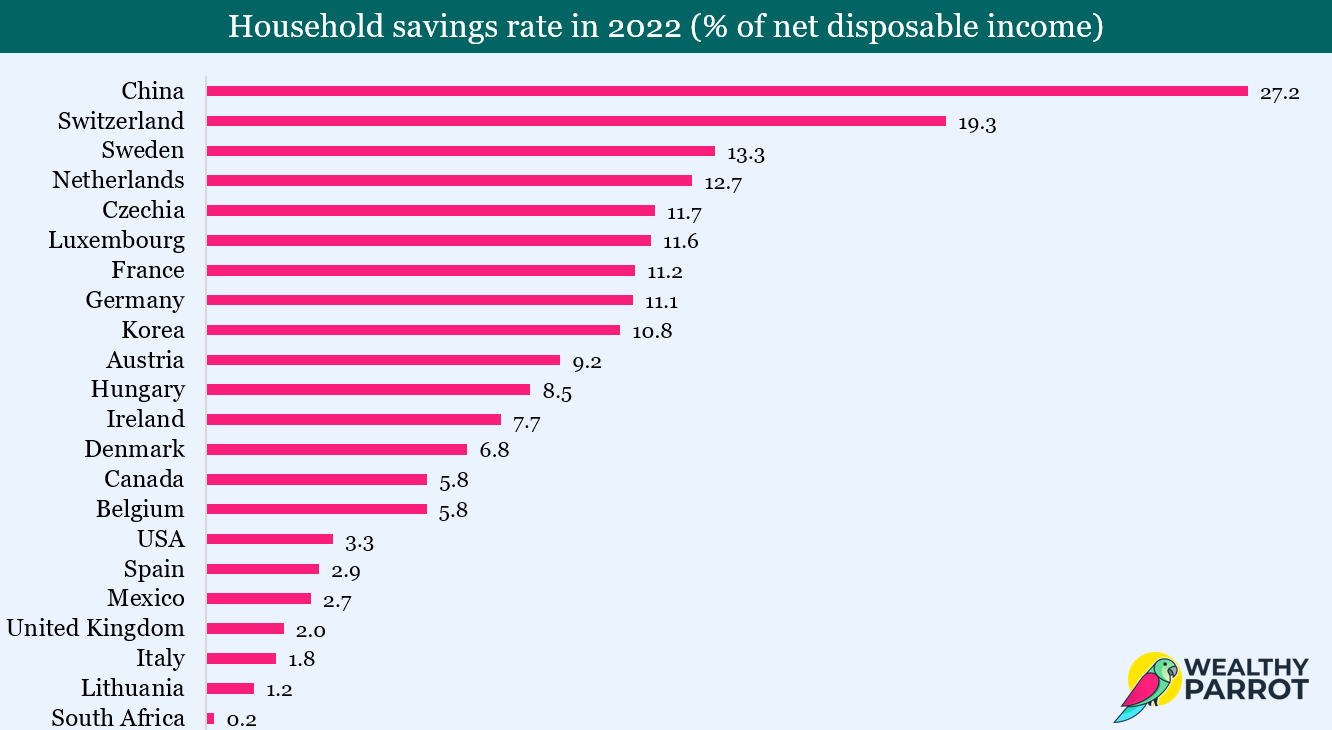

- Household savings rate: This is a big one! The household savings rate calculates the percentage of a household's disposable income that is saved instead of spent. A higher savings rate indicates that people are setting aside more of their earnings for the future. In countries like China and Switzerland, people tend to have high household savings rates because of cultural norms and financial prudence.

- Gross savings: Gross savings measures the total amount of money saved by both households and businesses within a country. It gives you a broad overview of how much money is being squirreled away. Economies with high gross savings often have more resources to invest in infrastructure and growth.

- National savings rate: This metric considers not only household and business savings but also includes savings at the government level. It's like a savings pot that represents the entire country's efforts to set aside funds. High national savings rates can help a country reduce its reliance on external borrowing.

- Savings as a percentage of GDP: This one relates savings to the overall economic output of a country, which is measured as Gross Domestic Product (GDP). A high savings-to-GDP ratio is often seen as a sign of economic stability and future growth potential.

No country saves in the same way

When it comes to saving, countries behave very differently. This is due to a mix of factors, from disposable income, to culture. For example, China high savings rate (27.2%, albeit on a declining trend) is due to a weak social safety net, an underdeveloped consumer credit market, a low degree of urbanization, a relatively young population, and a rapid economic growth.

If we exclude them, Switzerland with its tax heaven reputation, is at the top of the chart, with 19.3%.

Fun fact: the Federal Reserve estimated that U.S. households accumulated $2.3 trillion in savings between 2020 and the summer of 2021, pushed by the lockedown and uncertainty caused by the Covid-19 pandemic.

The household savings rate indicated in the analysis represents the total amount of savings as a percentage of net disposable income, meaning the net salary plus received social benefits and minus paid taxes.

Alright, now we're ready to go through some of the best ways to improve your savings.

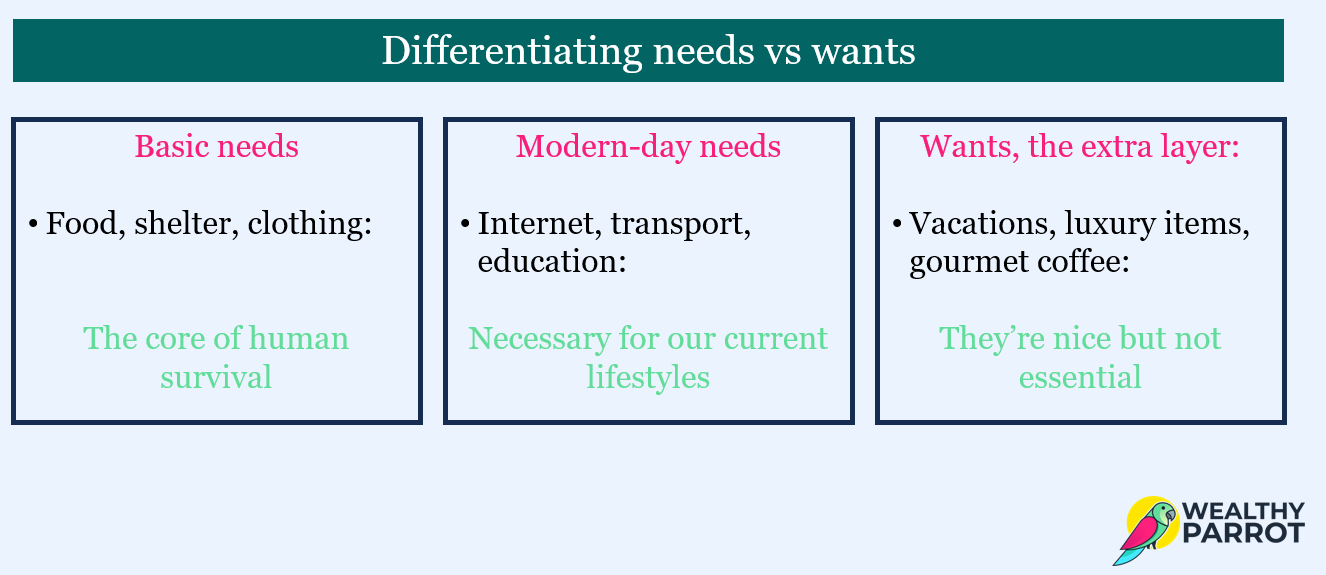

1. Understanding Needs vs. Wants

The line between needs and wants can often blur, especially when you're just starting out. Nonetheless understanding the distinction between them is paramount. This comprehension allows us to prioritize our spending, leading to a more structured and stress-free financial life.

Fun fact: A study by the American Journal of Economics found that young adults who differentiate between needs and wants save up to 25% more annually.

2. Set a clear goal and a budget

What is the main reason you are saving? You want more financial stability? Retire early? A new car? A trip around the world? Whatever is your main goal, think about it every time you are tempted at spending money on things that are probably not very essential:

- Make it specific and exciting: instead of "save money," aim for "beach vacation fund." The more vivid and specific, the more motivating it becomes.

- Break it down: large goals can seem daunting. Split them into smaller, achievable milestones to celebrate progress and maintain momentum.

- Visualize success: create a vision board or use imagery to picture yourself reaching your goal. This reinforces the positive emotions associated with saving.

How much should you save? As general rule of thumb, you might want to use the 50/30/20 rule: 50% of your income for needs, 30% for wants, and 20% for savings. Obviously this will depend on your level of income, but 20% of your income on saving should be the bare minimum.

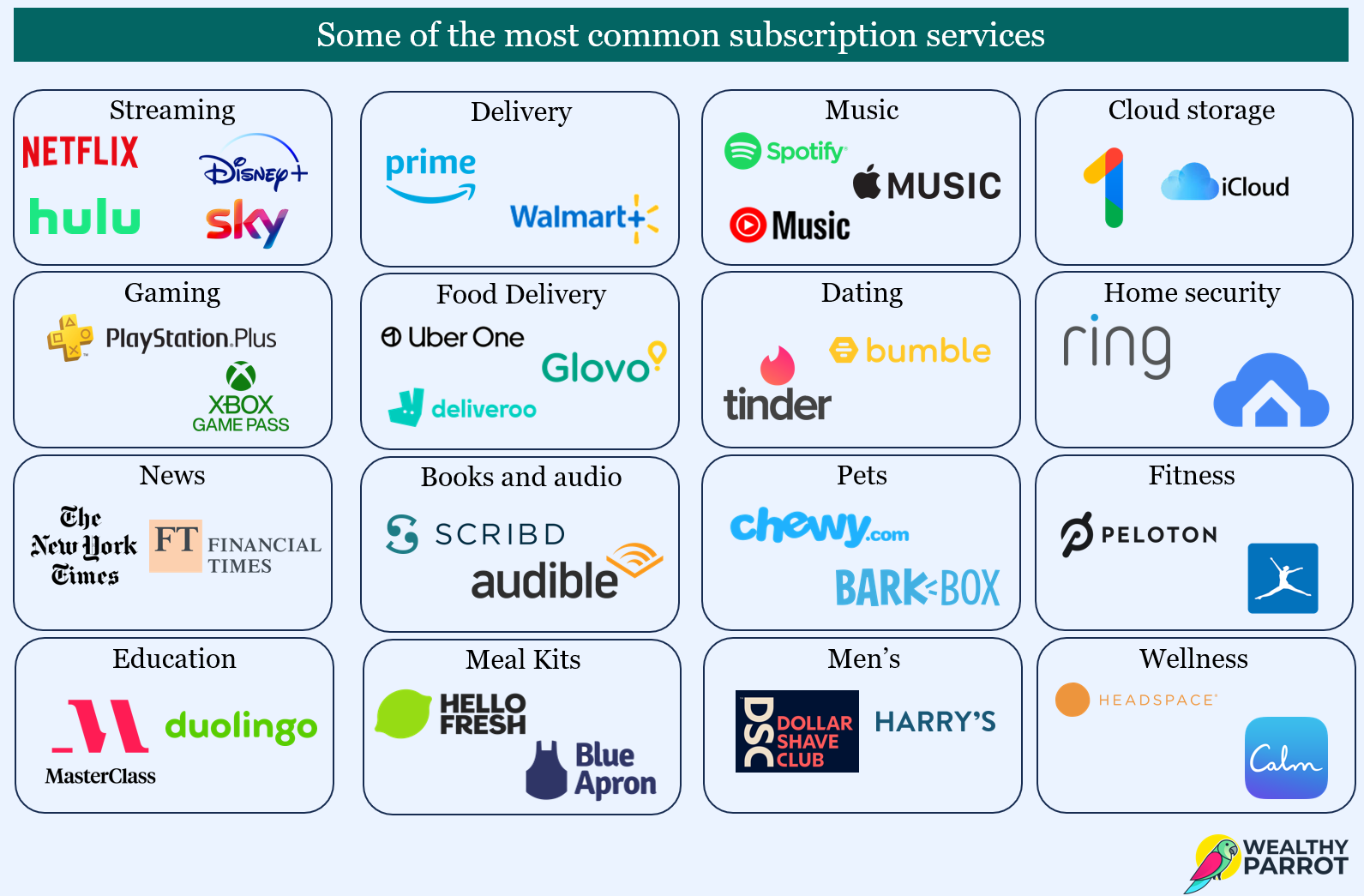

3. Cut down subscriptions

In our digital age, subscriptions can silently drain bank accounts. Many companies have moved from one-off payments to monthly or yearly plans.

And while each subscription might charge “only” a few dollars, once you add them up the total can be surprisingly high. According to bank N26, in Europe the average subscriber spends around 39 euros per month while in UK it’s around 41 pounds, the Independent reported. Things kind of get out of hand if you look at the US though, where an average American spends $219 a month on subscription services (CBS).

A good practice is to audit of all your subscriptions every 3-6 months and think if you REALLY use it or need it. Take the ones that are not useful anymore and cancel.

4. Pay yourself first

This is a classic. Treat your savings like a bill that must be paid each month. As soon as you receive your income, transfer a portion to savings. Even better, make it automatic. This way, you're prioritizing saving over spending.

5. DIY furniture and home decor

DIY (Do-It-Yourself) furniture and home decor can be a fantastic way to save money, while also adding a personalized touch to your living space. In addition there's a certain pride and satisfaction that comes from creating something with your own hands. This emotional value can be priceless.

One of the easiest way to start is using IKEA furniture. With their versatility and rage of products you can build pretty much anything else. To get started you can take a lot at the projects on Ikea Hackers.

6. Expense tracking

Track every expense you make. This can be done using apps, spreadsheets or specialized notebooks like Kakeibo, a Japanese method that promises a 30% increase in savings. You can read more about it in my article.

7. The envelope system

For better budgeting, use the envelope system :

- Divide your budget: first, you break down your monthly budget into different categories, such as groceries, dining out, entertainment, utilities, rent, and savings. Each category gets its own envelope.

- Allocate Cash: You then allocate a specific amount of cash into each envelope based on your budget for that category. This is the amount you’re allowed to spend for the month in that particular area.

- Spend From Envelopes: Whenever you need to make a purchase, you use the money from the appropriate envelope

8. Shop for groceries when prices are lower

Some supermarkets have lower prices on Wednesday because it is a mid-week day when stores are usually less crowded, and it is less costly for stores to reset their inventory on Wednesday or Thursday by reducing customer interference. Additionally, most stores start and end their weekly promotions on Wednesdays, so double the grocery promotions are available.

For daily savings, you can rely on apps like Too good to go that sell unsold items at a steep discounted price.

9. Participate in a Buy Nothing group to get free items

The Buy Nothing Project is a global movement that promotes the sharing, giving, and receiving of goods and services for free within local communities. It started in 2013 by friends Liesl Clark and Rebecca Rockefeller on Bainbridge Island, Washington, with the aim of reducing waste, saving resources, and fostering a sense of community. The initiative operates on the principle of generosity, encouraging participants to give freely without expecting anything in return.

Members of Buy Nothing groups typically use social media platforms, such as Facebook, to create local groups where they can post items they wish to give away, request items they need, or share skills and services with neighbors.

10. Quit smoking or drinking

Quitting smoking or drinking can lead to substantial financial savings, alongside the well-documented health benefits. The cost of cigarettes and alcoholic beverages adds up significantly over time. For example, if a pack of cigarettes costs $10 and a smoker goes through a pack a day, that's $3,650 spent in just one year. Similarly, frequent spending on alcohol—whether it's buying drinks at a bar or purchasing bottles to enjoy at home—can drain one's budget. By quitting, not only you save this money, but you also avoid the long-term medical costs associated with health issues.

11. Make saving a game

Is it possible to make saving fun? Of course! There are a couple tricks:

- Reward systems: implement a combination of rewards like points or badges once you have reached a certain amount of money saved or simply for being consistent every day. You can add tangible rewards, such as a small treat or your favorite coffee, again once received a milestone (e.g. 25%-50%-75%-100% of your saving goal).

- Visualize spending and saving patterns: use apps or tools that visualize spending and saving patterns to provide positive reinforcement and increase momentum. You might have something already from your bank app, but otherwise you can try YNAB or Money manager.

- Gamified investment platforms: some fintech brands gamify savings by offering rewards or gaming tickets for every unit of currency saved and invested.

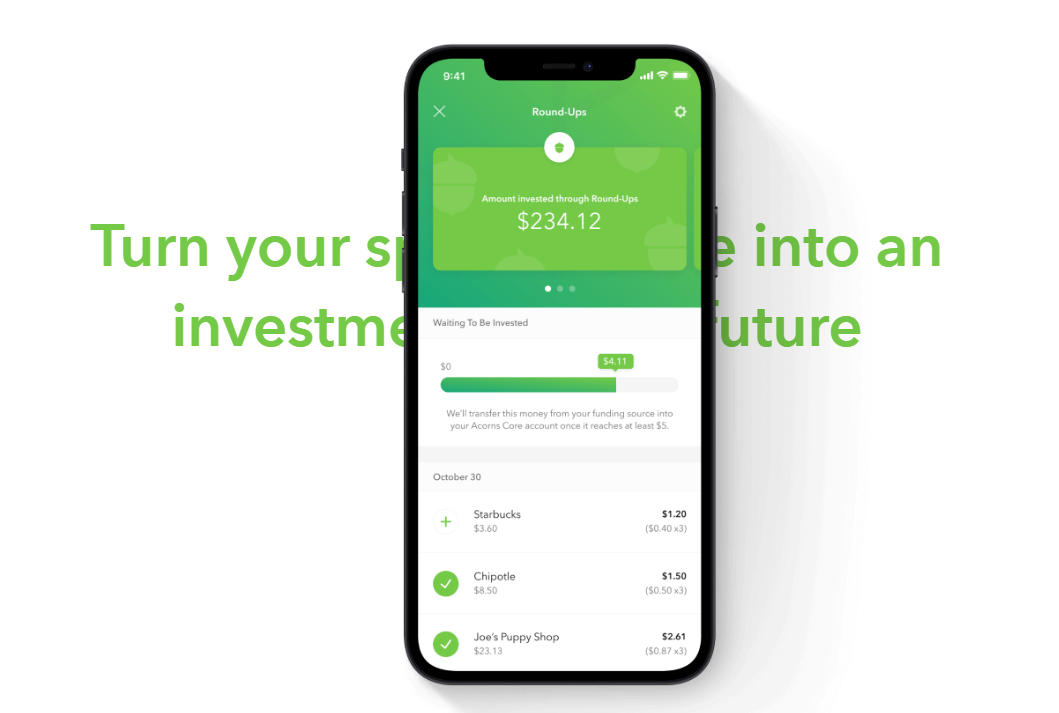

12. Round up apps

Utilize apps that round up your purchases and move the change directly to a savings account or an investment account. For every purchase, round up to the nearest dollar (or more) and save the difference. If you spend $3.50 on coffee, round up to $4 and put the extra 50 cents into savings. Some banks and apps offer this as a feature. Examples are Plum, Monzo, Acorns.

13. Minimize restaurant spending

The convenience of grabbing a meal on the go or dining out is undeniable, but it can also be a significant drain on your finances. Cooking at home is usually much more cost-effective.

Fun fact: According to the U.S. Bureau of Labor Statistics, the average American spends about $3,600 a year on dining out

14. The 52-week money challenge

The idea is straightforward: you save an increasing amount of money for each week of the year, starting with $1 on week one, $2 on week two, and so on, until you're saving $52 during the 52nd week of the year. If you follow this challenge to the letter, by the end of the year, you will have saved a total of $1,378! if you want a printable template, you can get mine here.

15. Use separate bank accounts

Create different accounts for specific goals – like a vacation, emergency fund, or a new car. It's fun to watch these individual goals grow and prevents you from dipping into a general savings pool.

16. Use the "one-in, one out" rule

Every time you buy something new, get rid of something old. This not only helps in decluttering but also makes you think twice about new purchases.

17. Consider opportunity cost

Ask yourself what else that money could be used for. Choosing to save means sacrificing something else, but visualizing the long-term benefits can help.

18. Find an accountability partner

Share your goals with a friend or family member and ask them to check in on you. Having someone to answer to can provide extra motivation.

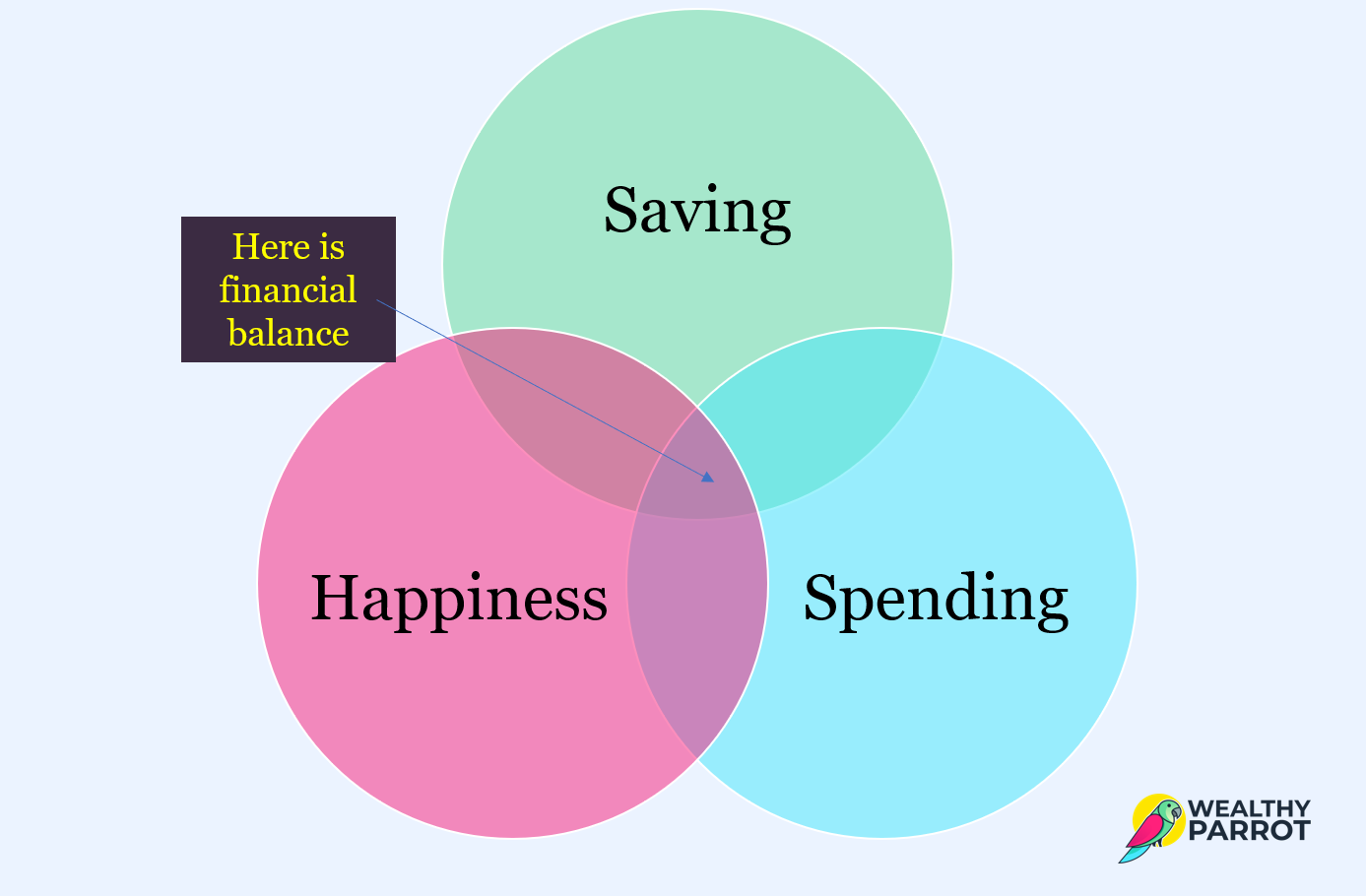

Conclusion: balance saving with life quality

As we've seen there plenty of saving strategies you can implement today. If you are not used to save much, it might be hard to resist the temptation to spend in the beginning, however I think saving is a bit like starting a diet: it gets easier the more you stick to it. And if it's true that spending too much is not good, the opposite is also valid. You want to be frugal, not cheap. And you want to find that sweet spot among saving, spending and what makes you happy to make saving sustainable.

And to make it sustainable takes time and effort. Be patient with yourself, celebrate your wins, and adjust your strategies as needed. By understanding your own psychology and using these tricks, you can boost your savings and reach your financial goals.