Investing strategies: analysis of technical vs. fundamental analysis - pros, cons

When it comes to investing, there are two main schools of thought – technical analysis and fundamental analysis. Technical analysis focuses on price movements and patterns, while fundamental analysis looks at a company's financials and underlying factors. Let's take a look at how you can use them - or don't use them - to make the most informed investment decisions.

Defining technical analysis and fundamental analysis

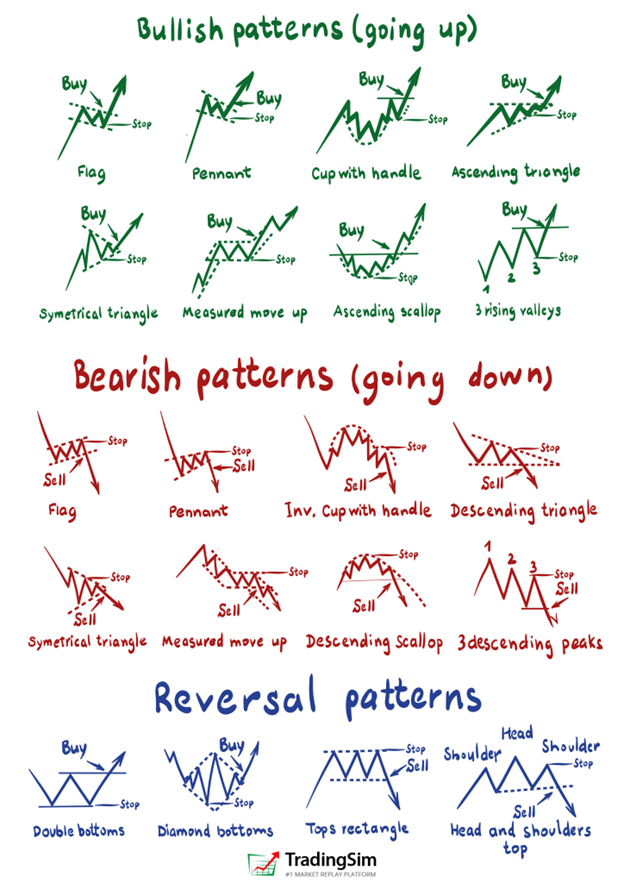

Technical analysis and fundamental analysis are both ways of analyzing financial markets, such as stocks and cryptocurrencies. Technical analysis uses primarily historical pricing data to identify trends or patterns and determine future prices for a stock, commodity, or currency. People that use this technique normally talk, among others, about Bollinger Bands, Fibonacci lines, stochastic oscillators, etc. The idea is to make the whole process of deciding when to buy or sell very visual. An example of the different patterns is below:

Fundamental analysis takes a different approach as it's more focused on the underlying financial health of a business, looking at things like its balance sheet, earning report and management changes to gauge investment decisions.

While technical analysis is known for its more short-term assessment of market trends, many investors look to fundamental analysis as an indication of a company's long-term prospects. Although they differ in their approach, each method can be used alone or in combination with the other in order to make informed trading and investing decisions.

Who are the most famous investors that use technical analysis

Technical analysis has been used by some of the most successful investors in history, including John Magee and Charles Dow. These two investing pioneers were among the first to use a technical approach in their investing strategies. Magee was an early proponent of charting, while Dow created what is now known as Dow Theory – which provides a set of guidelines for investing in the stock market. William P. Hamilton and Robert Rhea are also well-known technical analysts who developed various key technical indicators, such as moving averages and support/resistance levels. All four of these investing greats have used their knowledge of technical analysis to guide their investing decisions and help them to identify profitable opportunities in the markets.

Who are the most famous investors that use fundamental analysis

Fundamental analysis is another investing strategy that has been employed by investing legends such as Benjamin Graham, Warren Buffet, David Dodd, Bill Ackman and Seth Klarman. These investors are some of the most well-known fundamentalists in investing history and are noted for their in-depth research and analysis of a company’s financial information in order to establish a fair value for a security. By investing in companies with strong fundamentals and good management, these investors have been able to generate tremendous returns over time.

The pros and cons of each investment strategy

When it comes to investing, there is no one-size-fits-all strategy. It’s important to weigh the various pros and cons of each investing strategy before diving in. For instance, some may opt for high risk/high reward investments, understanding that potential losses could be quite significant. On the flip side, these investments have the potential for enormous gains under certain market conditions. Others may take a more conservative approach utilizing lower risk investments such as mutual funds or bonds; these investments tend to have reduced returns but come with less risk. Ultimately, it's up to each individual to decide which strategy works best for their personal goals and financial situation.

The ugly truth

Although there is people that do profit from using technical analysis, the key is consistency. There is a big difference between profiting every year and doing good for 1-2 and then lose it all for 5-6. Multiple studies have found that technical analysis fails to provide consistent returns over time, and in some cases, technical traders can even lose large sums of money. This is because technical analysis is based on technical indicators and chart patterns that are only looking at historical price movements, not taking into account the bigger picture. The past (performance) does not help predicting the future when it comes to investing, even more so if you rely only on some indicators. If it was that easy, everybody would get rich by just applying the indicators I showed in the picture above. Sorry, it doesn't happen.

This is not to say that fundamental analysis is the remedy to all the diseases in the world, as this technique also is not fail proof, but by looking at the health of the company you can at least build a more complete picture of the potential results of the company and decide if you want to invest into it. Needless to say, I am a supporter of fundamental analysis.