Accounting 101: balance sheet

The balance sheet is a picture of the working capital of the company in a specific moment in time, or in simple terms, all the things the company owns and owes:

Assets represent where the company has invested money, while Liabilities + Equity are where the company took the money to do the investments. For this reason, the two columns should balance each other, meaning total assets should equal the total of liabilities and shareholders' equity. Hence the name balance sheet.

Balance sheet: assets

As just mentioned, assets represent where the company invested money in order to function. Examples of items in this list are:

- Cash: the simplest thing is money in the bank, however there is more. As example, publicly traded stocks and bonds fall into this bucket. Basically anything that you can turn into cash in a day or less if you need to. Another name for this category is liquid assets.

- Accounts receivable (A/R): when company X buys a product or service from a supplier, it negotiates payment term, a "grace period" during which the company X does not pay an invoice but cashes-in money from its product/services sales. In a more technical language, accounts receivable represent the funds that customers owe the company for products or services that have been invoiced but not paid yet. This is the amount customers owe the company. Remember, revenue is a promise to pay, so accounts receivable includes all the promises that haven’t yet been collected. Why is this an asset? Because all or most of these commitments will convert to cash and soon will belong to the company. It’s like a loan from the company to its customers.

- Inventory: any company that produces (or resells) something has inventory e.g. manufacturers, wholesalers or retailers. Service companies typically don’t have much in terms of inventory, as their main asset is normally the people (employees) providing the service and not a physical good. Inventory can be grouped into three buckets:

- Raw materials that will be used to make products;

- Products that are under construction (work-in-process inventory, or just WIP - pronounced whip);

- Products that are ready to be sold, called finished goods inventory.

All inventory costs money as it is created at the expense of cash (plus it costs money to store it in a warehouse). A company always wants to carry as little inventory as possible, but at the same time have enough for its manufacturing processes for when customers come calling.

- Property, plant and equipment (PPE): this line on the balance sheet includes any physical asset a company owns such as buildings, machinery, trucks, computers, etc. The PPE figure is the total number of dollars it cost to buy all the facilities and equipment the company uses to operate the business. The price used is the purchase price as without a continuous appraisal it's very hard to know the current value of every asset.

- Accumulated Depreciation: it's the cumulative amount of depreciation that has been charged against all fixed assets. Beware that this is subtracted from the assets value (thus has a minus in front). Ok but what is depreciation? There are two aspects to it:

- It is a reduction in the value of the (tangible) asset over time, due to wear and tear

- It matches the cost of the asset (that has a useful life of more than a year) to the revenues earned by using the asset.

On the balance sheet a company accumulates all the depreciation charges. You can read more on this article on the income statement.

- Intangible assets: an intangible asset is an identifiable non-monetary asset without physical substance. Examples of intangible assets include computer software, licenses, trademarks (including brand names and publishing titles), patents, films, copyrights, franchises, customer or supplier relationships, customer loyalty, market share and marketing rights. A special type of intangible asset is Goodwill. Goodwill is found on the balance sheets of companies that have acquired other companies. It’s the difference between what a company paid for another company and what the physical assets of the acquired company are worth. You can almost think about it as the price paid for having a company already established rather than some property and plant with no process, customer, etc.

Balance sheet: liabilities

Liabilities represent where the company found (part of the) resources needed to buy items in the Assets list. They key difference compared to Equity, is that for the former, the source is third parties, while for the latter is mainly the company owner(s) and shareholders. Examples of items included are:

- Accounts payable: amounts due to vendors or suppliers for services or goods that have been received but not yet been paid for. The company receives goods and services from suppliers every day and typically doesn’t pay their bills for at least thirty days. The vendors, in effect, have loaned the company money.

- Short-Term loans: normally paid within one year.

- Long-Term liabilities: Most long-term liabilities are loans. But there are also other liabilities such as deferred bonuses or compensation, deferred taxes, and pension liabilities. These debts are called long term because they are payable beyond 12 months.

Balance sheet: equity

Equity represents where the company found (all or part of the) resources needed to buy items in the Assets column, using capital of the owner(s) or shareholders. Equity includes the capital provided by investors and the profits retained by the company over time. Another way to think about it, is that equity is the money that shareholders will get back after a company liquidates its assets and pays off its debts. Examples of items included are:

- Retained earnings: are the profits that have been reinvested in the business instead of being paid out in dividends

- Shareholders capital: put during the creation of the company or increased in a following moment

- Stocks: there are different types that give different rights to the owners. There are a few differences but if we focus on the main points:

- Preferred: gives no voting rights to shareholders (while common stock does), however are paid dividends before common shareholders.

- Common: the great majority of stock is issued in this form. Their owners are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders. On the pro side though they have voting rights.

- Treasury: the number of shares repurchased from the open market.

Putting it all together

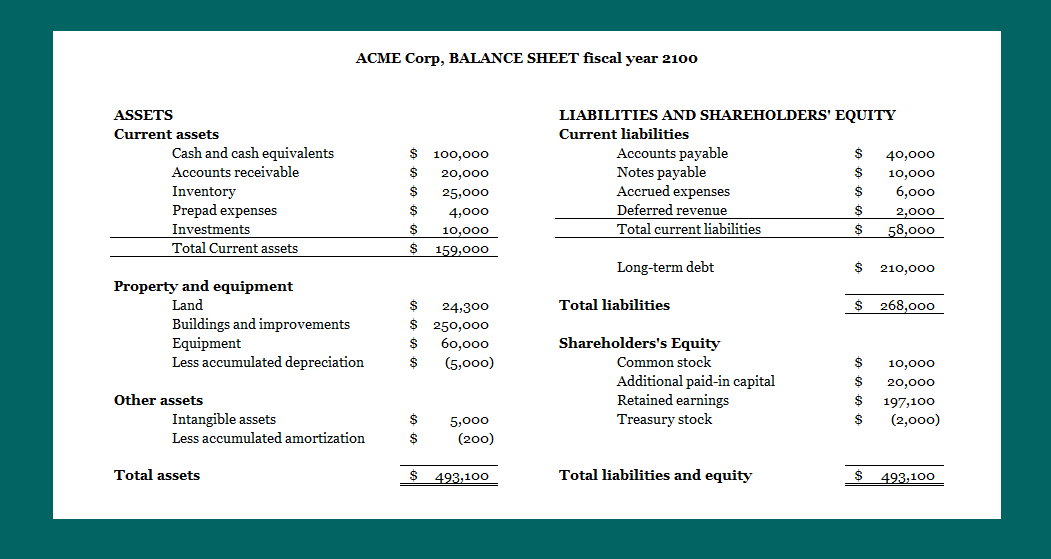

A very simple balance sheet would look like the below:

A couple notes:

- Current assets are those that have a life of more than a year

- Current liabilities are those that have to be paid off in less than a year

- You could find the Assets side by side with the liabilities or one of top of each other

Real life Example

The example above is very simple, but what about the balance sheet of a couple real, and even better, famous companies? Let's take a look at THIS article.